Powering Online Sales in Boca Raton with Ecommerce Payment Integration by UltraWeb Marketing

Ecommerce payment integration is the process of connecting your online store to a payment gateway, which securely processes customer transactions from credit cards and digital wallets to bank transfers. Think of the last time you bought something online. You clicked “Buy Now,” entered your details, and the transaction was complete in seconds. Simple, right?

For you as a business owner, that “simple” transaction involves your online store talking to payment gateways, processors, and banks—all while keeping customer data secure. Without proper payment integration, you risk losing sales to cart abandonment, facing security vulnerabilities, or paying unnecessarily high transaction fees. The right payment gateway integration can increase conversions, improve cash flow, and expand your market reach.

Here’s a quick guide to getting started:

- Choose a Payment Gateway: Select a provider like Stripe, PayPal, or Square.

- Set Up Your Merchant Account: This allows you to accept electronic payments.

- Obtain API Keys: Get your security credentials from your chosen provider.

- Integrate the Gateway: Use plugins for platforms like Shopify/WooCommerce or custom code.

- Test Thoroughly: Run test transactions in a sandbox environment before going live.

- Ensure PCI Compliance: Implement security standards to protect customer data.

- Go Live: Launch your payment system and start accepting real transactions.

Many South Florida business owners struggle with choosing the right payment solution. As Damon Delcoro, founder and CEO of UltraWeb Marketing, I’ve helped grow our in-house e-commerce business “Security Camera King” to over $20 million in annual revenue through strategic ecommerce payment integration. Our team has implemented secure, high-converting payment solutions for businesses throughout Boca Raton, Delray Beach, and South Florida, consistently delivering measurable ROI.

If you’re searching for a Web Designer Near Me or a trusted Website Design Company in Boca Raton, Delray Beach, or Deerfield Beach, UltraWeb Marketing integrates secure, conversion-focused checkouts into sites that drive revenue. Ready to boost sales? Contact our team for a free consultation: https://www.ultrawebmarketing.com/contact-ultraweb-marketing/

The Engine of Your Online Store: What is an Ecommerce Payment Gateway?

Think of a payment gateway as your online store’s digital cash register. It acts as a security guard and messenger, securely capturing a customer’s payment information, encrypting it, sending it to the banks for approval, and returning the result—all in seconds. Without this technology, your online store is like a showroom with locked doors; you can display products, but you can’t sell anything.

Why This Matters for Your Florida Business

For businesses in Boca Raton, Delray Beach, Deerfield Beach, and South Florida, choosing the right ecommerce payment integration is a business-critical decision. Your payment gateway directly impacts your sales, security, and customer trust. A well-integrated gateway enables you to accept payments 24/7, reduces failed transactions, and lets you expand beyond your local market to customers worldwide.

For your customers, it provides a fast, convenient, and secure way to pay using their preferred method, whether it’s a credit card, Apple Pay, or PayPal. This flexibility builds confidence and encourages them to complete their purchase. Global e-commerce sales are expected to reach US$5.9 trillion worldwide in 2023, and customers expect seamless digital payments.

If you’re a local owner searching for a Web Designer Near Me, UltraWeb Marketing is the Website Design Company trusted across Palm Beach and Broward County for secure, high-converting checkouts.

How Do Payment Gateways Securely Process Transactions?

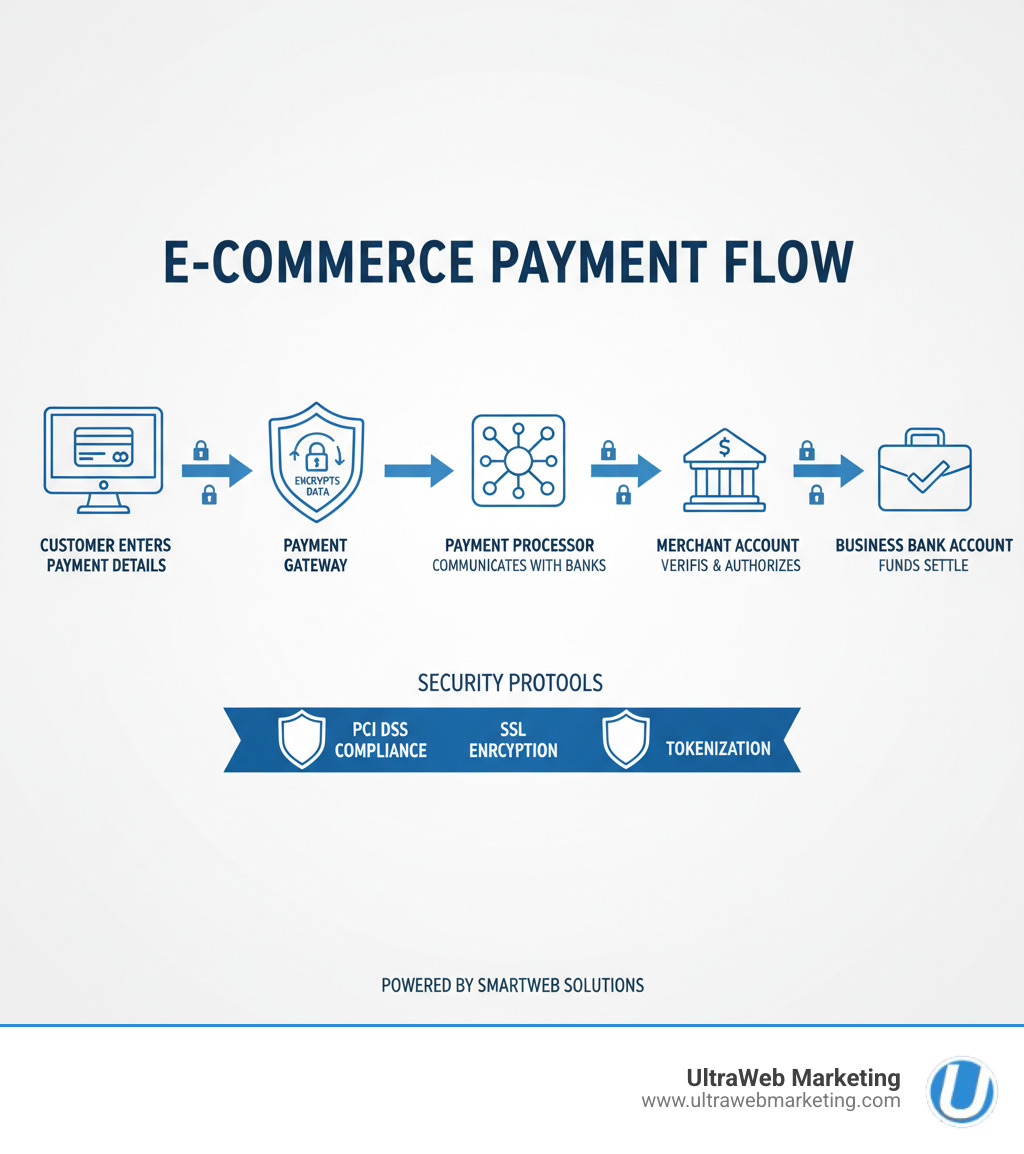

Here’s a quick look at what happens between “Buy Now” and “Order Confirmed”:

- Initiation: The customer enters their payment details at checkout.

- Encryption: The gateway scrambles the sensitive data into an unreadable code.

- Authorization: The gateway sends a request to the payment processor, which contacts the customer’s bank to check for sufficient funds and run fraud checks.

- Approval/Denial: The bank sends a response back through the processor to the gateway, which displays the result on your website.

- Settlement: The approved funds are transferred from the customer’s bank to your merchant account and then to your business bank account, typically within 1-3 business days.

Understanding the Key Players

- Payment Gateway: The secure tunnel that transmits payment data from your website to the financial network.

- Payment Processor: The coordinator that communicates between the gateway, banks, and card networks.

- Merchant Account: A special account where customer payments land before moving to your business bank account.

- Payment Method: How your customer chooses to pay (e.g., Visa, Apple Pay, PayPal).

Benefits for Your Business and Customers

A robust ecommerce payment integration delivers measurable benefits:

- Increased Sales: A smooth checkout process reduces friction and cart abandonment.

- Improved Cash Flow: Fast settlement times mean you get your money quicker.

- Improved Security: Advanced features like encryption and tokenization protect you and your customers from fraud.

- Customer Convenience: Offering multiple payment options builds loyalty and meets expectations.

- Expanded Market Reach: International capabilities let you sell to customers around the globe.

Our team at UltraWeb Marketing has seen how the right payment integration transforms online stores. To learn more about building an ecommerce site that converts, explore our Ecommerce Development services.

Choosing the Right Gateway for Your Florida Business

Selecting the right ecommerce payment integration is a critical decision for your South Florida business. The best choice depends on your specific needs, so there’s no one-size-fits-all solution. Consider these factors:

- Business Model: Are you selling physical products, digital downloads, or subscriptions? Subscription models require a gateway that excels at recurring billing.

- Transaction Volume: High-volume businesses may qualify for lower per-transaction fees, while startups might prefer a simple flat-rate structure.

- Target Market: If you plan to sell internationally, you’ll need a gateway that handles multiple currencies and popular overseas payment methods. Mobile wallets accounted for roughly half of global e-commerce payment transactions in 2023, so offering options like Apple Pay and Google Pay is crucial.

- Scalability: Choose a gateway that can grow with your business, handling increased volume without requiring a complete overhaul.

At UltraWeb Marketing, we help Florida businesses steer these decisions. Our team understands the local market and what works for businesses in South Florida. Check out our Ecommerce Solutions Florida to see how we can help.

Key Features to Compare

Payment integrations generally fall into three types:

- Hosted Gateways: Redirect customers to the provider’s secure page to pay. This is the easiest to set up and minimizes your PCI compliance burden, but offers less control over the user experience.

- Integrated (API) Gateways: Keep customers on your site for a seamless, branded checkout. This requires more technical setup and places more PCI responsibility on you, but offers a superior experience.

- Self-Hosted Gateways: Give you complete control by managing everything on your own servers. This is the most complex option, suitable only for large enterprises with dedicated development teams.

Beyond the type, evaluate these features:

- Fee Structures: Compare transaction, monthly, and setup fees.

- Security: Look for advanced fraud detection, encryption, and tokenization.

- Supported Payment Methods: Ensure you can accept major credit cards, digital wallets (Apple Pay, Google Pay), and other popular options.

- International Capabilities: Check for multi-currency support if you plan to sell globally.

Understanding the Costs

Payment gateway costs can be broken down into a few key areas:

- Transaction Fees: A percentage plus a fixed fee on every sale (e.g., 2.9% + $0.30).

- Monthly Fees: A recurring subscription for using the platform.

- Setup Fees: A one-time charge for account configuration.

- Chargeback Fees: A fee (typically $15-$25) assessed when a customer disputes a transaction.

- Hidden Costs: Watch for fees related to currency conversion or premium features.

To choose, estimate your monthly sales volume and average order value to calculate potential costs. However, don’t decide on price alone. A gateway with better features or security can provide more value in the long run. At UltraWeb Marketing, our online marketing plans start as low as $279 per month, and we focus on delivering measurable ROI. Contact us today for a free consultation on your e-commerce project!

Your Guide to Ecommerce Payment Integration

Setting up ecommerce payment integration is a straightforward process once you understand the steps. The method you choose will depend on your e-commerce platform, technical comfort level, and desired customer experience.

- API Integration: Offers the most control and a seamless customer experience by keeping users on your site. It requires developer expertise but results in a professional checkout that builds trust.

- Hosted Payment Pages: Redirects customers to the gateway’s secure page to complete payment. This is easier to set up and reduces your security compliance burden.

- Plugins and Extensions: The most beginner-friendly option for platforms like Shopify or WooCommerce. These pre-built tools can be installed and configured with minimal technical knowledge.

At UltraWeb Marketing, our expertise in Website Design for Ecommerce ensures your checkout process is optimized to convert browsers into buyers.

Key Steps for a Successful Ecommerce Payment Integration

Follow this roadmap for a successful setup:

- Choose Your Gateway: Select a provider based on your business needs, volume, and budget.

- Set Up a Merchant Account: If required by your gateway, open an account to accept payments.

- Obtain API Keys: Get your secure credentials from the gateway. Keep your secret key confidential.

- Install and Configure: Install the necessary plugin or libraries and enter your API keys. Configure your accepted payment methods and currencies.

- Test Thoroughly: Use the gateway’s sandbox mode to run test transactions. Check for successful payments, failed payments, and refunds to catch any issues.

- Go Live: Switch from test to live mode, replace your test API keys with live ones, and start accepting real payments.

Our team at UltraWeb Marketing has guided hundreds of South Florida businesses through this process. With online marketing plans starting as low as $279 per month, professional support is more affordable than you might think.

Navigating Security and Compliance

Security is the foundation of customer trust. Here’s what you need to know:

- PCI DSS Compliance: These are the industry standards for handling credit card data. Using a hosted gateway significantly reduces your compliance burden.

- SSL Certificates: An SSL certificate encrypts the connection between your customer’s browser and your website (indicated by “HTTPS”). It’s non-negotiable for any e-commerce site.

- Tokenization: This security feature replaces sensitive card numbers with unique tokens, which are useless to hackers. This allows for secure recurring billing and one-click checkouts.

- Fraud Detection: Modern gateways use machine learning to analyze transactions in real-time and flag suspicious activity, saving you from chargebacks and lost revenue. Friendly fraud costs retailers a collective $48 billion per year, making robust fraud detection essential.

We build security into every e-commerce platform we create for clients across South Florida. Contact us today to discuss how we can secure your e-commerce future.

Optimizing Your Checkout for Higher Conversions

Your checkout page is where a potential sale becomes a real one—or disappears. A clunky, confusing process is a primary cause of cart abandonment. Smart ecommerce payment integration is your secret weapon for turning browsers into buyers.

A well-designed checkout should feel effortless. Here’s how to optimize it:

- Offer Multiple Payment Methods: Customers have strong preferences. In addition to credit cards, offer digital wallets like Apple Pay and Google Pay, which are used in nearly half of all global e-commerce transactions.

- Simplify the Process: Use clear, simple steps with minimal friction. Features like one-click checkout for returning customers and guest checkout for new buyers remove significant barriers.

- Leverage Analytics: Your payment gateway collects valuable data. Use its reporting features to see where customers drop off, which payment methods are popular, and why transactions fail. This data provides a roadmap for improvement.

- A/B Test Your Options: Don’t guess what works. Test different layouts, button text, and payment option orders to find what resonates with your audience.

Our team of Ecommerce Specialists has helped businesses across South Florida transform their checkout experiences, turning abandoned carts into loyal customers.

Common Challenges in Ecommerce Payment Integration

Being aware of potential challenges helps you avoid them:

- Technical Difficulties: API integrations can be complex, leading to compatibility issues or bugs. Partnering with an expert minimizes these risks.

- Integration Failures: A poorly executed integration can lead to failed payments and lost sales. Thorough testing in a sandbox environment is crucial to catch errors before they affect customers.

- Security Breaches: A breach can destroy customer trust. Prioritize security by choosing a reputable gateway and implementing all recommended measures like PCI compliance and tokenization.

- High or Hidden Fees: Do your homework to understand the full cost structure. High transaction fees can eat into your profit margins, especially if you sell internationally.

- Poor Customer Support: When issues arise, you need responsive support. Choose a provider with a proven track record of excellent service.

How do you avoid these pitfalls? Partner with experts. At UltraWeb Marketing, we’ve handled countless ecommerce payment integrations for businesses throughout South Florida. Our team knows the common pitfalls and how to avoid them, ensuring a secure, high-converting setup. Our online marketing plans start as low as $279 per month, making expert guidance accessible for businesses of all sizes.

Frequently Asked Questions about Payment Integration

Here are answers to some of the most common questions we receive from businesses in Boca Raton, Delray Beach, and Boynton Beach about ecommerce payment integration.

Can I use multiple payment gateways on my ecommerce store?

Yes, and it’s often a smart strategy. Using multiple gateways allows you to offer more payment choices, which can increase conversions, especially for international customers. It also provides a valuable backup if one gateway experiences an outage, ensuring you don’t lose sales.

How long does it take to integrate a payment gateway?

The timeline varies. A simple plugin integration on a platform like Shopify or WooCommerce can take just a few hours. However, a custom API integration for a complex Ecommerce Website Development Florida project could take several weeks, depending on the specific requirements.

What is the most secure type of payment gateway?

For most small to medium-sized businesses, a hosted payment gateway is often considered the most secure option. It redirects customers to the gateway’s secure page, meaning sensitive data never touches your website and your PCI compliance burden is significantly reduced. For businesses wanting a seamless on-site checkout, an API-based gateway offers high security through features like tokenization and end-to-end encryption.

Let’s Build Your High-Converting Ecommerce Store

You’ve made it through the complexities of ecommerce payment integration. Choosing and implementing the right payment gateway is a strategic decision that secures your transactions, builds customer trust, and directly impacts your bottom line.

For businesses in Boca Raton, Delray Beach, and throughout South Florida, getting payment integration right open ups your full online potential. A seamless checkout experience turns first-time visitors into loyal customers.

At UltraWeb Marketing, we’ve spent over a decade helping local businesses create secure, high-performance ecommerce websites designed to maximize conversions. Our founder, Damon Delcoro, grew an in-house e-commerce business to over $20 million in annual revenue through strategic payment optimization. We bring that same expertise to every client project.

We handle the complex backend work so you can focus on growing your business. From selecting the right gateway to implementing robust security and optimizing your checkout flow, our team manages every detail.

Whether you need a complete Ecommerce Development solution, expert Web Design Boca Raton services, or a dedicated Web Designer Deerfield Beach to bring your vision to life, we have you covered. With online marketing plans starting as low as $279 per month, professional ecommerce solutions are more accessible than you might think.

Ready to transform your online sales? Contact us today for a free consultation on your e-commerce project! Let’s build something amazing together.